Multiple Choice

Manchester Ltd has a building that originally cost $850,000 and has accumulated depreciation of $120,000 as at 30 June 2002. It is decided on 1 July 2002 that the building should be revalued to $820,000. What are the appropriate entries to record the revaluation using the net method?

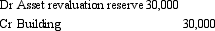

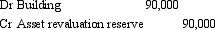

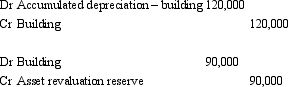

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: AASB 116 requires entities to review at

Q3: Which of the following statement is true

Q15: AASB 116 permits the following with respect

Q29: According to Positive Accounting Theory,the size of

Q33: Where an asset's carrying amount based on

Q41: Revaluations increments are often a source of

Q56: Chopin Ltd has a debt contract and

Q56: Recoverable amount is the amount expected to

Q59: Australia is the only country that allows

Q71: AASB 136 does not require the use