Multiple Choice

Peters Ltd has a machine that originally cost $20,000 and has accumulated depreciation of $5,000. Its remaining life is assessed to be 5 years with no salvage value. The directors of Peters Ltd decide on 1 July 2003 to revalue the machine. They are unable to find market information on a machine in a similar state to theirs, so the market value of a new machine of the same type, $30,000, is used as a basis. What is/are the appropriate journal entry(ies) to record the revaluation?

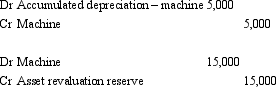

A)

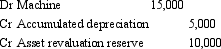

B)

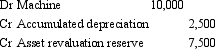

C)

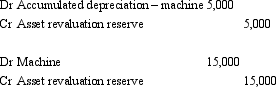

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: When an entity adopts the valuation model

Q24: Which of the following statement is true

Q34: Where the value of revalued non-current assets

Q35: AASB 116 requires that where the replacement

Q39: The process of discounting future cash flows

Q45: Positive accounting theory suggests that the revalution

Q49: Brahms Ltd acquired a property of land

Q52: AASB 116 prescribes that,if assets within the

Q57: Depreciation method used and depreciation rates are

Q60: A sale of property plant and equipment