Multiple Choice

A machine purchased by White Ltd had a cost of $670,000 and an accumulated depreciation balance of $120,000 at 30 June 2002. Its fair value is assessed at this time, with its first revaluation as $450,000. What is/are the appropriate journal entry(ies) to record the revaluation?

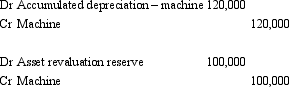

A)

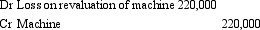

B)

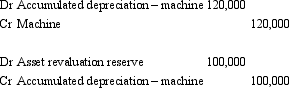

C)

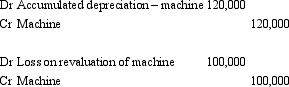

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If an asset's carrying amount is impaired,AASB

Q4: Once an entity elects to value a

Q7: Hendersons Ltd has just begun to revalue

Q8: Pigeon Ltd purchased land for $750,000 6

Q11: Stairway Ltd is undertaking its regular review

Q25: Where management's bonuses are tied to profit-based

Q32: AASB 136 requires that:<br>A) If a non-current

Q36: Under AASB 116 when an asset is

Q51: The revaluation model is a tool used

Q72: The concept of conservatism requires that if