Multiple Choice

Mendelssons Ltd has a machine that has been revaluing over a number of years. The valuation as at 1 January 2002 is $130,000. The previous valuation was $145,000 and the accumulated depreciation is $40,000. The revised salvage value is $15,000 and the estimated useful life remaining is 12 years. The benefits from the machine are expected to be derived evenly over its life. In the previous year, the machine had been devalued by $15,000 and this amount written off to the income statement. What are the entries at 1 January 2002 to record the revaluation and at 31 December 2002 to record depreciation?

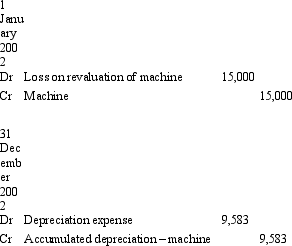

A)

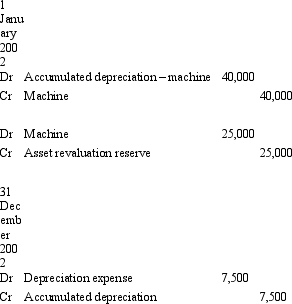

B)

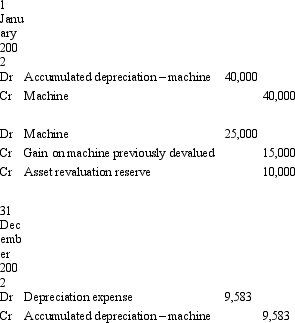

C)

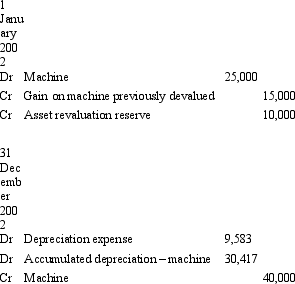

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: AASB 116 provides guidance on fair values

Q18: Smith & Jones Ltd owns equipment that

Q23: Burchells Ltd owns a machine that originally

Q27: Where there are debt covenants in place

Q30: Casey Co Ltd is assessing the recoverable

Q34: If an asset is subject to depreciation

Q38: Entities that elect to report plant and

Q46: Which of the following statements is a

Q50: Once a class of non-current assets has

Q73: AASB 116 requires that revaluation increments and