Multiple Choice

Cars and Trucks Limited owns an engine testing machine which was purchased for $120,000. After 3 years of use the machine had accumulated depreciation of $58,560 but was revalued to $80,000. Two years later the machine was sold for $60,000 and had accumulated depreciation at the time of sale of $36,800. What journal entries would be required to record the sale of the machine in accordance with AASB 116 requirements?

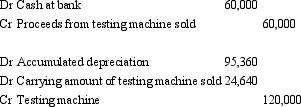

A)

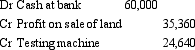

B)

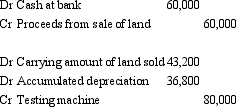

C)

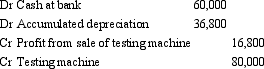

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Mozart Ltd acquired a building for $1.5

Q12: On disposal of an asset a gain

Q15: AASB 116 permits the following with respect

Q17: AASB 116 provides guidance on fair values

Q23: Burchells Ltd owns a machine that originally

Q23: An entity that elects the revaluation model

Q30: Casey Co Ltd is assessing the recoverable

Q32: Seagull Marinas Ltd owns land that was

Q34: If an asset is subject to depreciation

Q58: A class of non-current assets as defined