Multiple Choice

Staples Ltd has invested in two parcels of land that are treated as belonging to the same class of assets. The first parcel of land was purchased for $500,000 and has been valued this period at $650,000. The second parcel of land has a carrying value of $340,000 and has been valued this period at $100,000. What is the appropriate journal entry to record the revaluations?

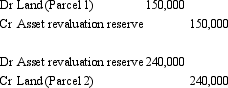

A)

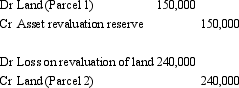

B)

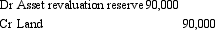

C)

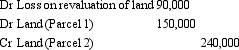

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If an asset's carrying amount is impaired,AASB

Q4: Once an entity elects to value a

Q7: Hendersons Ltd has just begun to revalue

Q8: Pigeon Ltd purchased land for $750,000 6

Q11: Stairway Ltd is undertaking its regular review

Q14: Research using the Positive Accounting Theory approach

Q16: Under AASB 116 when an asset is

Q18: Brown,Izan and Loh (1992)found that revaluations are

Q46: Which of the following statements is a

Q50: Once a class of non-current assets has