Multiple Choice

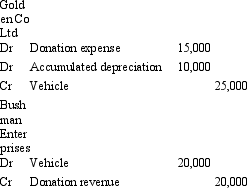

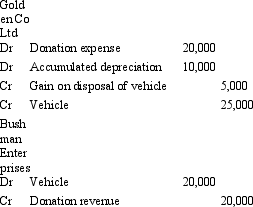

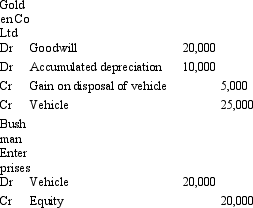

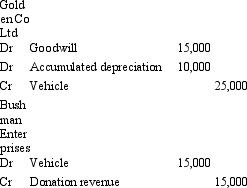

Golden Co Ltd has donated a vehicle to Bushman Enterprises as a result of publicity about the plight of Bushman Enterprises after bushfires destroyed most of its fleet of vehicles. The vehicle had cost Golden Co $25 000 and has accumulated depreciation of $10 000. Its market value is $20 000. How should the asset transfer be recorded in both companies' books?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: If an assets 'value in use' exceeds

Q16: Bella Enterprises recorded as an asset a

Q20: If the entity received a donated asset

Q28: Recoverable amount of an asset is defined

Q42: The AASB Framework allows use of different

Q46: Which of the following items is not

Q56: For an asset to be recognised,it is

Q57: The description of 'probable' in the AASB

Q58: If the expected value in use of

Q67: Advertising expenditures are typically expensed as incurred