Multiple Choice

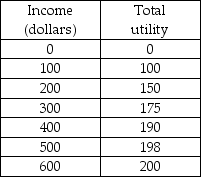

-James has a utility of wealth schedule in the above table. He is offered a job selling video games at Games Galore. James' compensation depends on how much he sells. In a poor sales period, a salesperson makes $100 per month. In a good sales period, a salesperson makes $600 per month. James is told by the manager that, in any given month, there is a 25 percent chance of a poor sales period and a 75 percent chance of a good sales period. Suppose that one of James' professors offers him the opportunity to be a research assistant for a fixed and guaranteed amount each month. What amount must James' professor pay in order to make James indifferent between being a research assistant and working at Games Galore?

A) $300 per month

B) $350 per month

C) $475 per month

D) $600 per month

Correct Answer:

Verified

Correct Answer:

Verified

Q204: Signals are believable when the cost of

Q205: Suppose that there are only two types

Q206: Jon is risk averse. When he buys

Q207: Explain the concept of adverse selection. Give

Q208: A risk averse person has diminishing marginal

Q210: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Ashton has the

Q211: Mike owns a car worth $20,000, and

Q212: The cost of risk is the amount

Q213: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Larry owns a

Q214: Adriana wants to try working as an