Multiple Choice

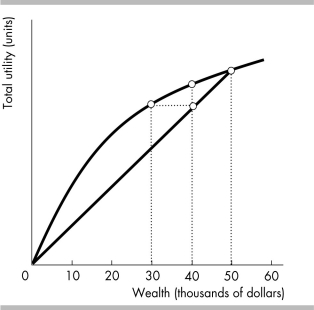

-The above figure shows the utility of wealth curve for a homeowner whose only possession is a $50,000 house. If there is a 20 percent chance that the home could be completely destroyed, would this homeowner buy insurance?

A) No, because the homeowner is not risk averse.

B) Yes, at any price because the homeowner is risk averse.

C) Yes, but only if it costs less than $10,000.

D) Yes, but only if it costs less than $20,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q150: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -John's utility of

Q151: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Andrew's utility of

Q152: Adverse selection is created by<br>A) incentives to

Q153: Pablo must choose among options A, B,

Q154: Questions about employment history on a loan

Q156: George is considering buying shares of Intel.

Q157: Without warranties, used car buyers can assume

Q158: For a risk averse person, the marginal

Q159: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Lucy works as

Q160: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -The above figure