Essay

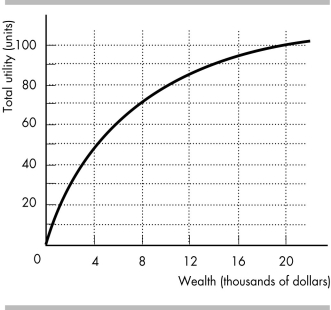

-Mike has the utility of wealth curve shown in the figure above. He owns a car worth $20,000, and that is his only wealth. There is a 10 percent chance that Mike will have an accident within a year. If he does have an accident, his car is worthless.

a) What is Mike's expected utility?

b) What is the maximum amount that Mike is willing to pay for auto insurance?

c) Suppose all car owners are like Mike insofar as they have a 10 percent chance of having an accident. An insurance company agrees to pay each person who has an accident the full value of his or her car. The company's operating expenses are $1,000. What is the minimum insurance premium that the company is willing to accept?

d) Will Mike buy the company's policy? Why or why not?

Correct Answer:

Verified

a) If Mike has an accident, his utility ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q156: George is considering buying shares of Intel.

Q157: Without warranties, used car buyers can assume

Q158: For a risk averse person, the marginal

Q159: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -Lucy works as

Q160: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -The above figure

Q162: In an ad for insurance, the text

Q163: You took a summer job as a

Q164: For a risk averse person, an increase

Q165: Katy has an ailing and wealthy, but

Q166: If Sally drives less carefully after buying