Multiple Choice

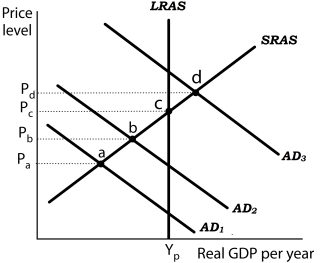

Figure 16-3

Panel (a) Panel (b)

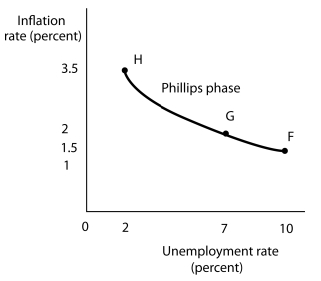

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

-Refer to Figure 16-3. If the economy were experiencing a recessionary gap, it would be Joperating at

A) point a only.

B) point b only.

C) either point a or point b.

D) point d only.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Along an actual (observed) Phillips curve,<br>A) aggregate

Q3: The efficiency-wage theory holds that the market

Q31: Each point on a Phillips curve is

Q65: The vertical long-run Phillips curve occurs in

Q110: Figure 16-7 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5507/.jpg" alt="Figure 16-7

Q111: Figure 16-8 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5507/.jpg" alt="Figure 16-8

Q116: What are the three phases of the

Q117: Figure 16-7 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5507/.jpg" alt="Figure 16-7

Q118: Which of the following statements is true

Q119: In the short run and in the