Multiple Choice

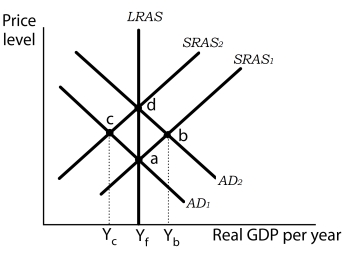

Figure 11-5

-Refer to Figure 11-5. If the economy is at point b, the Federal Reserve can close the output gap by selling bonds. In the bond market,

A) the supply curve shifts right, leading to a decrease in bond prices and an increase in interest rates.

B) the demand curve shifts right, leading to an increase in bond prices and a decrease in interest rates.

C) the supply curve shifts left, leading to an increase in bond prices and an increase in interest rates.

D) the demand curve shifts left, leading to a decrease in bond prices and an increase in interest rates.

Correct Answer:

Verified

Correct Answer:

Verified

Q62: The delay between the time at which

Q74: The Fed can raise the target for

Q88: Suppose the interest rate is zero and

Q92: Figure 11-4 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5507/.jpg" alt="Figure 11-4

Q94: In the short-run velocity is not constant.

Q95: What is the rational expectations hypothesis? Using

Q99: Figure 11-5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5507/.jpg" alt="Figure 11-5

Q137: Changing the required reserve ratio is an

Q144: The time between recognizing the existence of

Q178: The problem of lags suggests that monetary