Multiple Choice

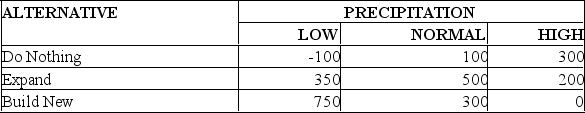

The operations manager for a well-drilling company must recommend whether to build a new facility,expand his existing one,or do nothing.He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:  If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

A) $140,000

B) $170,000

C) $285,000

D) $305,000

E) $475,000

Correct Answer:

Verified

Correct Answer:

Verified

Q46: The owner of Tastee Cookies needs to

Q47: A manager has developed a payoff table

Q48: The advertising manager for Roadside Restaurants,Inc.needs to

Q50: The owner of Tastee Cookies needs to

Q52: A sensitivity analysis graph:<br>A)provides the exact values

Q53: A tabular presentation that shows the outcome

Q54: One local hospital has just enough space

Q55: The advertising manager for Roadside Restaurants,Inc.needs to

Q56: The sum over the states of nature

Q151: The head of operations for a movie