Multiple Choice

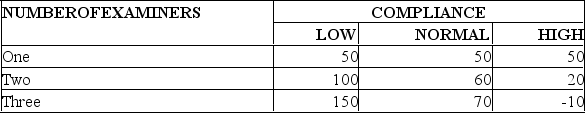

The local operations manager for the Canada Revenue Agency must decide whether to hire one,two,or three temporary tax examiners for the upcoming tax season.She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Parliament,as follows:  If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what are the expected net revenues for the number of assistants she will decide to hire?

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what are the expected net revenues for the number of assistants she will decide to hire?

A) $26,000

B) $46,000

C) $48,000

D) $50,000

E) $76,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Determining the probability distribution which results in

Q4: Decision trees are analyzed from left to

Q5: One local hospital has just enough space

Q6: The EVPI indicates an upper limit on

Q7: The construction manager for Acme Construction,Inc.must decide

Q9: The operations manager for a well-drilling company

Q10: One local hospital has just enough space

Q12: Decision maker's values,preferences and attitudes toward risk

Q13: In order to use the expected value

Q70: The head of operations for a movie