Multiple Choice

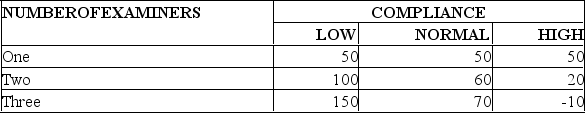

The local operations manager for the Canada Revenue Agency decides whether to hire one,two,or three temporary tax examiners for the upcoming tax season.She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Parliament,as follows:  If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what is her expected value of perfect information?

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what is her expected value of perfect information?

A) $16,000

B) $26,000

C) $46,000

D) $48,000

E) $50,000

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The advertising manager for Roadside Restaurants,Inc.needs to

Q21: The owner of Tastee Cookies needs to

Q22: A former politician,who is now the owner

Q23: In a decision tree,square nodes represent chance

Q24: The owner of Tastee Cookies needs to

Q26: The owner of Tastee Cookies needs to

Q27: Two professors at a nearby university want

Q28: A structured approach to decision making is

Q29: Decision trees are useful when there is

Q30: Influence diagrams contain more detailed information than