Short Answer

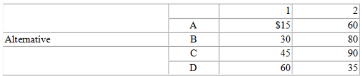

A manager has learned that annual profits from four alternatives being considered for solving a capacity problem are projected to be $15,000 for A, $30,000 for B, $45,000 for C, and $60,000 for D if state of nature 1 occurs; and $60,000 for A, $80,000 for B, $90,000 for C, and $35,000 for D if state of nature 2 occurs.

(i) If P(State of Nature 1) is .40, what alternative has the highest expected monetary value?

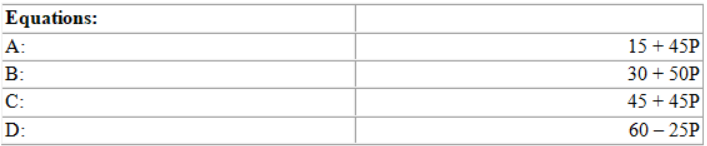

(ii) Determine the range of P(S2) for which each alternative would be optimal.

(i) Max EMV is C ($72)

(ii) Refer to the diagram, above.

Ranges:

D is optimal from 0 < .214

C is optimal from > .214 to 1.00

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The operations manager for a well-drilling company

Q10: One local hospital has just enough space

Q12: Decision maker's values,preferences and attitudes toward risk

Q13: In order to use the expected value

Q15: Typically the choice to "do nothing" based

Q17: One local hospital has just enough space

Q18: Two professors at a nearby university want

Q19: A manager is quite concerned about the

Q70: The head of operations for a movie

Q115: Graphical sensitivity analysis is limited to cases