Multiple Choice

Table 9-3

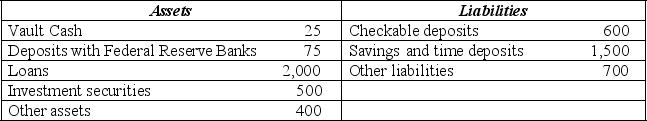

Balance Sheet of the Alpha-Beta Bank

(All figures in $ million)

-Refer to Table 9-3. If the required reserve ratio is 10% and the market interest rate is 6%, then the opportunity cost of holding excess reserves is

A) zero since Alpha-Beta does not hold any excess reserves.

B) $0.9 million.

C) $2.4 million.

D) $4 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q53: Money is any item that<br>A) serves as

Q89: What happens when you withdraw cash from

Q136: Suppose a bank has $50,000 in deposits

Q160: Which of the following describes the store

Q186: Keeping a $20 bill in your purse

Q193: Table 9-3<br>Balance Sheet of the Alpha-Beta Bank<br>(All

Q195: Table 9-5<br>Bolton Bank: Partial Balance Sheet<br>(All figures

Q197: Table 9-6: Deposit Expansion Stages<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5507/.jpg"

Q199: Table 9-4<br>Acme Bank: Partial Balance Sheet<br>(All figures

Q203: Table 9-3<br>Balance Sheet of the Alpha-Beta Bank<br>(All