Essay

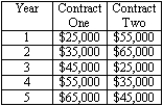

You are considering two work contracts, each of which lasts for five years. The two contracts are summarized in the following table.  Assume that you will be paid at the end of each year. Contract 1 includes a signing bonus of $5,000 to be paid at the beginning of year 1, whereas contract 2 does not include a signing bonus. If the interest rate is 5 percent, which is the better offer?

Assume that you will be paid at the end of each year. Contract 1 includes a signing bonus of $5,000 to be paid at the beginning of year 1, whereas contract 2 does not include a signing bonus. If the interest rate is 5 percent, which is the better offer?

Correct Answer:

Verified

The present discounted value o...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: The discount rate is commonly measured by

Q117: A dollar in the future is worth

Q120: The present discounted value of a $35

Q126: The percentage rate used to calculate the

Q130: Discounting is the process of calculating how

Q134: The present discounted value is today's value

Q147: The process of determining how much a

Q169: Suppose you win a million dollars in

Q173: The present discounted value of $75 to

Q178: With zero inflation, a dollar received today