Essay

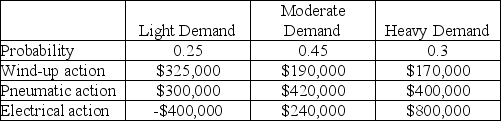

A toy manufacturer has three different mechanisms that can be installed in a doll that it sells. The different mechanisms have three different setup costs (overheads) and variable costs and, therefore, the profit from the dolls is dependent on the volume of sales. The anticipated payoffs are as follows.

a. What is the EMV of each decision alternative?

a. What is the EMV of each decision alternative?

b. Which action should be selected?

c. What is the expected value with perfect information?

d. What is the expected value of perfect information?

Correct Answer:

Verified

(a) Wind-up=.25*$325,000 + .45*$190,000 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Explain the graphical shapes used in decision

Q15: The first step, and a key element,

Q17: Which of the following is<b>not</b> considered a

Q49: Bratt's Bed and Breakfast, in a small

Q54: Suppose a manufacturing plant is considering three

Q59: A problem that involves a sequence of

Q60: Which technique results in an optimistic decision?<br>

Q64: The expected value with perfect information assumes

Q77: The last step in the analytic decision

Q98: A(n) _ is an occurrence or situation