Essay

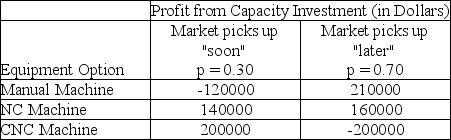

Steve Gentry, the operations manager of Baja Fabricators, wants to purchase a new profiling machine (it cuts compound angles on the ends of large structural pipes used in the fabrication yard). However, because the price of crude oil is depressed, the market for such equipment is down. Steve believes that the market will improve in the near future and that the company should expand its capacity. The table below displays the three equipment options he is currently considering, and the profit he expects each one to yield over a two-year period. The consensus forecast at Baja is that there is about a 30% probability that the market will pick up "soon" (within 3 to 6 months) and a 70% probability that the improvement will come "later" (in 9 to 12 months, perhaps longer).

a. Calculate the expected monetary value of each decision alternative.

a. Calculate the expected monetary value of each decision alternative.

b. Which equipment option should Steve take?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The campus bookstore sells highlighters that it

Q8: What is the EMV for Option 2

Q9: The expected value with perfect information is<br>A)

Q11: In the context of decision-making, define state

Q17: _ is the expected payout or value

Q18: The EMV of a decision with three

Q28: Earl Shell owns his own Sno-Cone business

Q73: There are three equally likely states of

Q85: Identify and describe three methods used for

Q92: The EMV of a decision with three