Essay

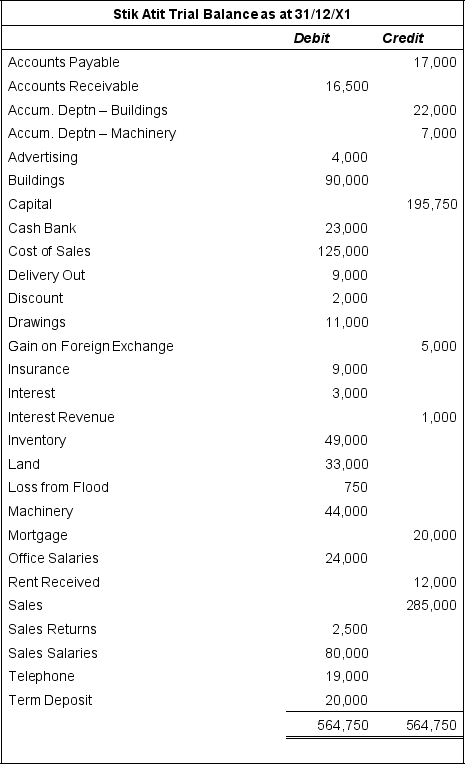

The following information is available at balance date of 31/12/X1;ignore GST:

1.Bad debts to be written off are $4,500.

1.Bad debts to be written off are $4,500.

2.Buildings depreciation rate is 2% straight line for the whole year.

3.Machinery depreciation rate is 20% diminishing value for the whole year.

4.Insurance was commenced and paid on 1 April 20X1 for a whole year.

5.The last rent received was for 3 months in advance on 1/11/X1;rent is $1,000 per month.

6.The term deposit interest rate is 10%;interest was last received on 30/06/X1 to cover up to and including that date.

7.Sales salaries are $8,000 per month;they were last paid on 31/10/X1 to cover up to that date.

State the names of accounts affected by these adjustments,the type of account,whether the account increases or decreases,the adjustment amount,and any necessary calculation.

Below is an example of how to set out your

Correct Answer:

Verified

1.Bad Debts Expense ↑ 4,500

Accounts Rec...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Accounts Rec...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Other comprehensive income items:<br>A)are realised items that

Q11: Which of the following defines Financial expenses?<br>A)Costs

Q12: Distinguish between cash basis accounting and accrual

Q13: Explain the 3 aspects of the NZ

Q14: Your friend Randolph has been reading about

Q16: For an item to be recorded as

Q17: Which of the following defines General and

Q18: Which of the following defines Selling and

Q19: Craig Smith purchased a retail sports clothing

Q20: Recording an item as capital expenditure instead