Multiple Choice

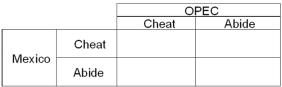

Mexico and OPEC both produce crude oil.Realizing that it would be in their best interest to form an agreement on production goals,a meeting is arranged and an informal,verbal agreement is reached.If both Mexico and OPEC stick to the agreement,OPEC will earn profit of $200 million and Mexico will earn profit of $100 million.If both Mexico and OPEC cheat,then OPEC will earn $175 million and Mexico will earn $80 million.If only OPEC cheats,then OPEC earns $185 million and Mexico $60 million.If only Mexico cheats,then Mexico earns $110 million and OPEC $150 million.

-Refer to the information given above.Suppose OPEC told Mexico that,in the event Mexico cheats on the agreement,OPEC will cheat as well,but if Mexico does not cheat,neither will OPEC.This is an example of

A) a commitment problem.

B) a credible threat.

C) an empty promise.

D) using preferences as a solution to a commitment problem.

E) an empty threat.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Two competitive firms are located side by

Q44: The table below shows the payoff matrix

Q45: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3714/.jpg" alt=" In the above

Q46: Games in which players find that playing

Q47: The table below shows the payoffs to

Q49: Cartels would be more stable if<br>A) firms

Q50: Collusive control over price may permit oligopolists

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3714/.jpg" alt=" In the above

Q52: Mexico and OPEC both produce crude oil.Realizing

Q53: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3714/.jpg" alt=" -Suppose the demand