Multiple Choice

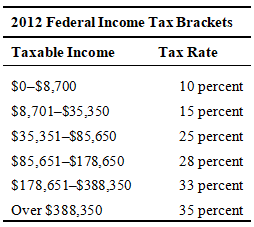

Refer to the following table to answer the following questions:

-Using the table,what is the new average tax rate for a person who currently makes $80,000 per year and receives a $10,000 raise?

A) 20.7 percent

B) 20.0 percent

C) 28.0 percent

D) 27.5 percent

E) 22.3 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Use the following table to answer the

Q62: The largest source of tax revenue for

Q63: Under a progressive tax system,Elaine earned a

Q64: Mandatory outlays<br>A) usually change during the budget

Q65: Which of the following might be a

Q67: The total current tax rate for Social

Q68: The United States has a _ income

Q69: Under the U.S.system of social insurance,the employer

Q70: Prior to the creation of the income

Q71: Some proponents of entitlement-program reform suggest indexing