Multiple Choice

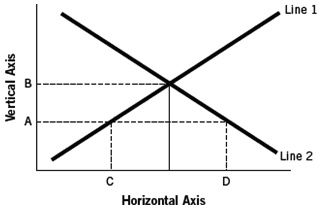

Refer to the following graph to answer the following questions:

-Assuming the figure represents the market for loanable funds,and that point C represents 40 and point D represents 80,then it would be true that

A) both points represent interest rates and there is a surplus of loanable funds at an 80 percent interest rate.

B) both points represent interest rates and there is a shortage of loanable funds at an 80 percent interest rate.

C) both points represent the quantity of loanable funds and there would be a surplus of loanable funds of 40 units.

D) both points represent the quantity of loanable funds and at interest rate A there would be a shortage of loanable funds of 40 units.

E) the quantity of loanable funds supplied exceeds the quantity demanded at interest rate B,if B represents an interest rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: Which combination of events could have caused

Q78: If foreign income and wealth decrease,this would

Q79: The gap between the real and nominal

Q80: What is meant by the savings rate,and

Q81: If real rates were higher than nominal

Q83: The fact that people prefer to receive

Q84: In the 1960s,President Kennedy advocated an "investment

Q85: If time preferences increase,<br>A) the demand for

Q86: You borrow $10,000 today at a nominal

Q87: What would be an example of increased