Essay

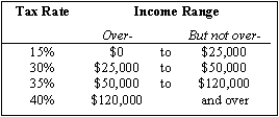

Exhibit 14-3

-Refer to Exhibit 14-3. Calculate the average tax rate of an individual whose taxable income is $65,000 and who has total deductions and exemptions of $10,000.

Correct Answer:

Verified

22 percent

Tax on first = $25,000 = $25,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Tax on first = $25,000 = $25,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: A means-tested transfer program intended to help

Q25: The effect of the personal income tax

Q26: As a result of government tax and

Q27: A government payment to an individual because

Q28: For a mandated benefit to decrease total

Q30: The table below gives the income distribution

Q31: Taxes cause deadweight losses because they<br>A)raise market

Q32: U.S. government tax and transfer policies have

Q33: Property taxes are the largest sources of

Q34: Exhibit 14-5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6906/.jpg" alt="Exhibit 14-5