Essay

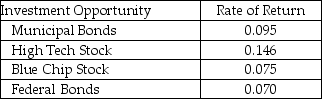

First Securities, Inc., an investment firm, has $380,000 on account. The chief investment officer would like to reinvest the $380,000 in a portfolio that would maximize return on investment while at the same time maintaining a relatively conservative mix of stocks and bonds. The following table shows the investment opportunities and rates of return.  The Board of Directors has mandated that at least 60 percent of the investment consist of a combination of municipal and federal bonds, 25 percent Blue Chip Stock, and no more than 15 percent High Tech Stock. Formulate this portfolio selection problem using linear programming.

The Board of Directors has mandated that at least 60 percent of the investment consist of a combination of municipal and federal bonds, 25 percent Blue Chip Stock, and no more than 15 percent High Tech Stock. Formulate this portfolio selection problem using linear programming.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: A computer start-up named Pear is considering

Q35: Cedar Point amusement park management is preparing

Q37: Friendly Manufacturing has three factories (1, 2,

Q40: Describe the production scheduling linear programming application.

Q47: Linear programming is usually used by managers

Q58: What are the decision variables in the

Q77: The linear programming model of the production

Q80: Dr.Malcomb Heizer wishes to invest his retirement

Q80: Since the production mix linear program applications

Q91: Table 8-1<br>A small furniture manufacturer produces tables