Essay

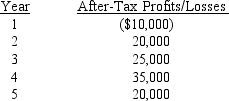

Assume that the cost of certain equipment your business is considering purchasing is $100,000. You plan to depreciate the equipment over five years, at which point the salvage value is expected to be $8,000. Anticipated after-tax profits (losses) are as follows:

Compute the accounting return on investment. (Show the formula and your computations.)

Compute the accounting return on investment. (Show the formula and your computations.)

Correct Answer:

Verified

Accounting return on investmen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Discuss the working-capital cycle of a small

Q82: A disadvantage of the accounting return on

Q83: Which of the following questions do all

Q84: When a business sells its accounts receivable

Q85: If capital budgeting is so important, why

Q87: You Make the Call-Situation 3<br>Adrian Fudge of

Q88: The payback period technique deals with accounting

Q89: Average annual after-tax profits per year divided

Q90: The discounted cash flow technique measures the

Q91: Which of the following is not a