Essay

You Make the Call-Situation 1

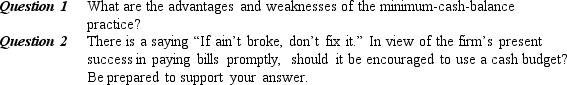

A small firm specializing in the sale and installation of swimming pools was profitable but devoted very little attention to management of its working capital. It had, for example, never prepared or used a cash budget. To be sure that money was available for payments as needed, the firm kept a minimum of $25,000 in a checking account. At times, this account grew larger; it totaled $43,000 at one time. The owner felt that this approach to cash management worked well for a small company because it eliminated all of the paperwork associated with cash budgeting. Moreover, it had enabled the firm to pay its bills in a timely manner.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following is not an

Q38: The limited use of discounted cash flow

Q39: Failure to take cash discounts from suppliers<br>A)

Q42: Working capital management focuses on the attractiveness

Q42: In making capital budgeting decisions, small business

Q43: A strength of the accounting return on

Q44: Discounted cash flow techniques consider the time

Q45: In using the net present value method,

Q46: Accounting profits are not identical to actual

Q91: The internal rate of return method estimates