Essay

You Make the Call-Situation 2

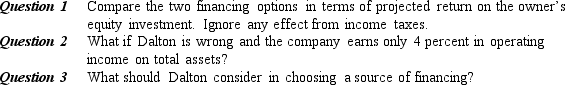

Carter Dalton is well on his way to starting a new venture-Max, Inc. He has projected a need for $350,000 in initial capital. He plans to invest $150,000 himself and either borrow the additional $200,000 or find a partner who will buy stock in the company. If Dalton borrows the money, the interest rate will be 6 percent. If, on the other hand, another equity investor is found, he expects to have to give up 60 percent of the company's stock. Dalton has forecasted earnings of about 16 percent in operating income on the firm's total assets.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: The federal government provides funds to small

Q31: Asset-based lending is a type of financing

Q32: One potential problem with acquiring funds from

Q33: A _ mortgage would likely be used

Q38: Borrowing allows owners to retain voting control

Q39: The age of a company has little

Q39: The assets most commonly used for security

Q112: Qualified small businesses that cannot obtain business

Q123: Commercial investors are sometimes called business angels.

Q129: Generally,as long as a firm's operating income