Essay

You Make the Call-Situation 2

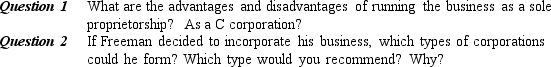

Matthew Freeman started a business in 1993 to provide corporate training in project management. He initially organized his business as a sole proprietorship. Until 1999, he did most of his work on a contract basis for Corporation Education Services (CES). Under the terms of his contract, Freeman was responsible for teaching 3- to 5-day courses to corporate clients-primarily Fortune 1000 companies. He was compensated according to a negotiated daily rate, and expenses incurred during a course (hotels, meals, transportation, etc.) were reimbursed by CES. Although some expenses were not reimbursed by CES (such as those for computers and office supplies), Freeman's expenses usually amounted to less than 1 percent of his revenues.

In 1999, Freeman increasingly found himself working directly with corporate clients rather than contracting with CES. Over the years, he had considered incorporating but had assumed the costs and inconveniences of this option would outweigh the benefits. However, some of his new clients said that they would prefer to contract with a corporation rather than with an individual. And Freeman sometimes wondered about potential liability problems. On the one hand, he didn't have the same liability issues as some other businesses-he worked out of his home, clients never visited his home office, all courses were conducted in hotels or corporate facilities, and his business involved only services. But he wasn't sure what would happen if a client were dissatisfied with the content and outcomes of his instruction. Finally, he wondered whether there would be tax advantages to incorporating.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A sole proprietorship is a business owned

Q3: The owner of a new venture wants

Q4: The key to strong management in a

Q5: A strategic alliance is:<br>A)an organizational relationship that

Q9: Any weakness in the management of a

Q10: An entrepreneur's social network could include all

Q11: Explain the importance of a strong management

Q84: Which of the following entities is liable

Q98: If partners cannot resolve disputes between themselves,

Q115: Upon the death of the majority stockholder