Multiple Choice

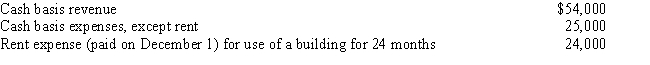

Becky is a cash basis taxpayer with the following transactions during her calendar tax year: What is the amount of Becky's taxable income from her business for this tax year?

A) $7,000 loss

B) $11,000

C) $27,500

D) $28,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: BOND Corporation is owned 25 percent by

Q30: On January 1, 2015, Sandy, a sole

Q31: Steve Corp bought a $600,000 apartment building

Q32: An asset (not an automobile) placed in

Q34: If extended by Congress, bonus depreciation in

Q36: In applying the statutory rates from the

Q36: Annualizing" is a method by which the

Q38: Amy is a calendar year taxpayer reporting

Q39: Under MACRS, the same method of depreciation

Q85: Section 179 immediate expensing can be taken