Essay

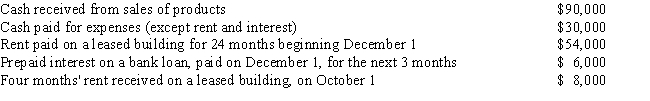

Polly is a cash basis taxpayer with the following transactions during the year:

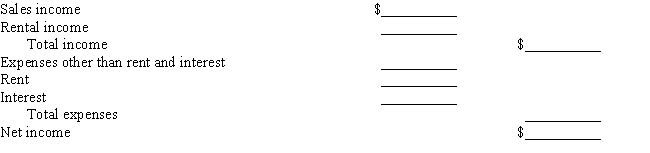

Calculate Polly's income from her business for this calendar year.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Which one of the following is true

Q23: The hybrid method of accounting involves the

Q52: The tax law imposes restrictions on the

Q75: Routine maintenance costs for capital assets are

Q84: Depreciation refers to the physical deterioration or

Q103: In 2015, a taxpayer purchases a new

Q104: On May 2, 2015, Scott purchased a

Q107: A taxpayer places a $50,000 5-year recovery

Q109: Taxpayers may expense the cost of depreciable

Q110: Quince Corporation changes its year-end from a