Essay

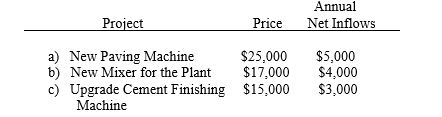

Pave-It, Inc. is trying to decide whether to purchase a new paving machine, purchase a new mixer for the plant or to upgrade the cement finishing machine. All of the alternatives are viewed as having the same ten year project life and none are expected to have any salvage value. However, different project prices are applicable to each and each has a different expected stream of annual net cash inflows. The firm's managers believe that a discount rate of 12 percent is appropriate for evaluating the alternatives. Data are as follows:

After examining the project prices, management finds it has sufficient capital budget to complete two of them. Assuming that the cash inflows from the project are independent of one another, which two projects should be undertaken?

Correct Answer:

Verified

Present value of new paving machine:

The...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: A project has an anticipated stream of

Q11: The net cash flow of a project

Q12: Pronto Delivery is contemplating an investment in

Q13: The marginal cost of capital MCC) is

Q14: The amount that would be accumulated at

Q16: A project has an anticipated stream of

Q17: A project has an anticipated stream of

Q18: Afterthought Construction Co. is about to sell

Q19: Discounting is the process of computing the

Q20: Afterthought Construction Co. is about to sell