Multiple Choice

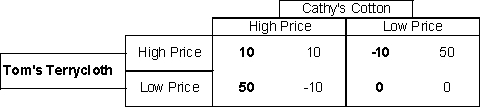

The following table is for two towel companies. They each offer cotton towels that are highly absorbent and fluffy even though they are made from different cottons. Since every household uses towels, these firms believe that there will always be a tomorrow for their product. Both Tom and Cathy have agreed to charge high prices in order to make a more than normal profit.  Which of the following is true?

Which of the following is true?

A) in the long run, it is in Cathy's Cotton's best interest to defect from their agreement and charge a lower price.

B) in the long run, it is in Tom's Terrycloth's best interest to defect from their agreement and charge a lower price.

C) there is no incentive for either firm to defect from the agreement

D) the agreement is only rational as long as the interest rate is sufficiently low to make the gains from defecting less than the present value of the of the profit obtained from colluding.

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Search costs are the economic costs incurred

Q2: Extensive form game is a game that

Q3: Nash equilibrium is a game outcome in

Q5: Franie's Futons currently sells 55 futons a

Q6: Frank's Futons currently sells 55 futons a

Q7: A strategy is a choice or a

Q8: A term applied to a situation wherein

Q9: The following game tree is for two

Q10: Given the following tables, Nash equilibrium occurs

Q11: Asymmetric information is when one party to