Essay

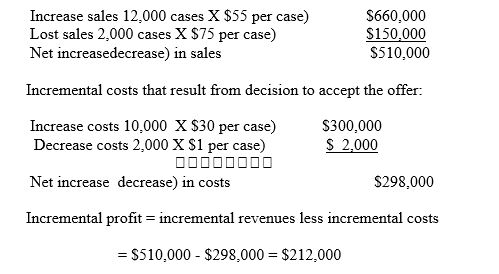

AUTHOR'S NOTE - As the acceptance of the offer entails no variable selling and administrative expenses, the total variable costs associated with producing the needed cases is $30.00 per case. This is arrived at by dividing total variable manufacturing expense of $300,000 by the 10,000 case output level. Acceptance of the offer also means that the $1.00 per case in variable selling and administrative expenses $10,000 divided by 10,000 cases) will not have to be paid on the 2000 cases of lost sales. Also, the problem assumes that the 7,000 cases used from inventory will be replaced out of excess future capacity. However, the cost of doing so, because it results form the decision to accept the offer, must be included in the incremental costs associated with its acceptance. Thus, the 10,000 cases referred to in the incremental cost analysis represents the 3,000 cases manufactured utilizing unused capacity and the 7,000 cases of inventory which must be replaced.

Incremental revenues which results from decision to accept the order:

Yes, accept the offer because incremental revenues exceed incremental costs.

-Complete the following cost and revenue data and find the profit-maximizing price and out put.

Correct Answer:

Verified

Profit is maximized at P = $7....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Total profit will be maximized where total

Q10: For the short run, which of the

Q11: The unit contribution margin equals the price

Q12: Given the following total and marginal cost

Q13: Fill out the following table and find

Q15: The goal of the firm is not

Q16: Incremental revenue is additional revenue that a

Q17: Find Ruth's Green Thumb's new breakeven output

Q18: Jim's Car Rental has fixed costs of

Q19: A firm has the following sales data