During the Year,Garbin Corporation (A Calendar-Year Corporation That Manufactures Furniture)purchased

Multiple Choice

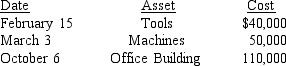

During the year,Garbin Corporation (a calendar-year corporation that manufactures furniture) purchased the following assets:  In computing depreciation of these assets,which of the following averaging conventions will be used?

In computing depreciation of these assets,which of the following averaging conventions will be used?

A) Half-year and mid-month

B) Mid-quarter and mid-month

C) Half-year,mid-quarter,and mid-month

D) Mid-quarter only

Correct Answer:

Verified

Correct Answer:

Verified

Q20: If more than 40 percent of all

Q27: Conrad Corporation has a June 30 year

Q29: Explain how the basis of an asset

Q34: The only acceptable convention for MACRS realty

Q39: The after-tax cost of an asset increases

Q42: Section 179 expenses exceeding the annual cost

Q52: The after-tax cost of an asset<br>A)Is higher

Q74: Sanjuro Corporation (a calendar-year corporation)purchased and placed

Q82: Josephine Company purchases five-year MACRS property in

Q84: What are listed properties?