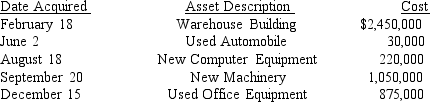

Sanjuro Corporation (A Calendar-Year Corporation)purchased and Placed in Service the Following

Multiple Choice

Sanjuro Corporation (a calendar-year corporation) purchased and placed in service the following assets during 2014:  All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2014.

What is Sanjuro Corporation's maximum deduction for cost recovery for the warehouse for 2015?

A) $62,818

B) $55,052

C) $49,809

D) $44,566

Correct Answer:

Verified

Correct Answer:

Verified

Q2: MACRS means<br>A)Modified asset cost recovery system<br>B)Mid-year accelerated

Q36: The alternative depreciation system uses a straight-line

Q37: What are the permissible tax treatments for

Q43: What is the difference between cost and

Q49: Sanjuro Corporation (a calendar-year corporation)purchased and placed

Q50: All of the following are acceptable conventions

Q50: Sanjuro Corporation (a calendar-year corporation)purchased and placed

Q55: Sanjuro Corporation (a calendar-year corporation)purchased and placed

Q57: What is the difference in the basis

Q57: Chipper,a calendar-year corporation,purchased new machinery for $1,125,000