Multiple Choice

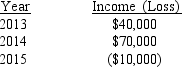

Hoku Corporation (a C corporation) had the following history of income and loss:  How much of a tax refund can Hoku Corporation receive by carrying back its 2015 loss?

How much of a tax refund can Hoku Corporation receive by carrying back its 2015 loss?

A) $1,500

B) $2,500

C) $3,500

D) None; it cannot carry its loss back

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Partnerships and S corporations are flow-through entities.

Q17: What are the fiduciary entities and how

Q47: Which of the following types of taxes

Q49: Mason owns 45% of an S corporation

Q61: Which of the following is never included

Q84: Allred Corporation has taxable income of $467,000

Q91: What is an individual's maximum annual deduction

Q93: What is Jerry's income tax savings (rounded

Q93: Terri owns a 50 percent interest in

Q107: Which of the following is not a