Multiple Choice

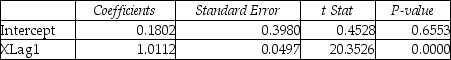

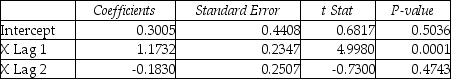

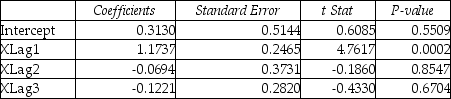

TABLE 16-9

Given below are EXCEL outputs for various estimated autoregressive models for a company's real operating revenues (in billions of dollars) from 1989 to 2012.From the data,you also know that the real operating revenues for 2010,2011,and 2012 are 11.7909,11.7757 and 11.5537,respectively.

First-Order Autoregressive Model:  Second-Order Autoregressive Model:

Second-Order Autoregressive Model:  Third-Order Autoregressive Model:

Third-Order Autoregressive Model:

-Referring to Table 16-9 and using a 5% level of significance,what is the appropriate autoregressive model for the company's real operating revenue?

A) First-Order Autoregressive Model

B) Second-Order Autoregressive Model

C) Third-Order Autoregressive Model

D) Any of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: True or False: Given a data set

Q35: The annual multiplicative time-series model does not

Q80: The effect of an unpredictable,rare event will

Q117: TABLE 16-10<br>Business closures in Laramie, Wyoming from

Q128: TABLE 16-13<br>Given below is the monthly time-series

Q150: TABLE 16-9<br>Given below are EXCEL outputs for

Q157: TABLE 16-14<br>A contractor developed a multiplicative time-series

Q158: TABLE 16-8<br>The manager of a marketing consulting

Q161: TABLE 16-5<br>The number of passengers arriving at

Q164: The cyclical component of a time series<br>A)represents