Multiple Choice

TABLE 13-7

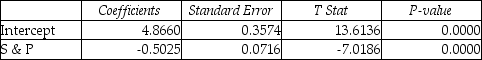

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Table 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the appropriate null and alternative hypotheses are,respectively,

A) H0 : ρ ≥ 0 vs.H1 : ρ < 0.

B) H0 : ρ ≤ 0 vs.H1 : ρ > 0.

C) H0 : r ≥ 0 vs.H1 : r < 0.

D) H0 : r ≤ 0 vs.H1 : r > 0.

Correct Answer:

Verified

Correct Answer:

Verified

Q51: The strength of the linear relationship between

Q52: TABLE 13-9<br>It is believed that, the average

Q84: True or False: The coefficient of determination

Q125: TABLE 13-4<br>The managers of a brokerage firm

Q140: TABLE 13-3<br>The director of cooperative education at

Q153: TABLE 13-13<br>In this era of tough economic

Q203: TABLE 13-9<br>It is believed that,the average numbers

Q204: TABLE 13-10<br>The management of a chain electronic

Q207: TABLE 13-2<br>A candy bar manufacturer is interested

Q211: TABLE 13-12<br>The manager of the purchasing department