Short Answer

TABLE 5-7

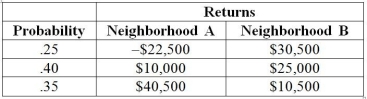

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if your investment preference is to minimize the amount of risk that you have to take and do not care at all about the expected return, will you choose a portfolio that will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Correct Answer:

Verified

Correct Answer:

Verified

Q85: The local police department must write,on average,5

Q127: The number of power outages at a

Q175: The Poisson distribution can be used to

Q180: A professor receives, on average, 24.7 e-mails

Q181: TABLE 5-8<br>Two different designs on a new

Q182: TABLE 5-6<br>The quality control manager of Green

Q184: TABLE 5-10<br>An accounting firm in a college

Q188: TABLE 5-8<br>Two different designs on a new

Q189: On the average, 1.8 customers per minute

Q190: What type of probability distribution will most