Essay

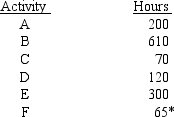

Willy is involved in a number of businesses as a consultant. Below are the businesses and the hours of activity that Willy spent in each. Identify any activities that are passive and explain why the income or loss from the other activities is not passive income or loss.  *F is Willy's sole proprietorship and he has no employees.

*F is Willy's sole proprietorship and he has no employees.

Correct Answer:

Verified

C: THE ONLY PASSIVE ACTIVITY

B: Willy pa...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

B: Willy pa...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following may not be

Q6: Nathan's basis for his interest in the

Q10: Which of the following cannot be taxed

Q17: Which of the following is not a

Q30: James and Jerry are equal partners in

Q50: Mario, who is married filing a joint

Q51: Jared owns 50% of an S corporation's

Q52: For 2018, compare the income and FICA

Q54: Other Objective Questions<br>Indicate by a PRP if

Q62: An S election terminates<br>A)when a shareholder dies.<br>B)when