Multiple Choice

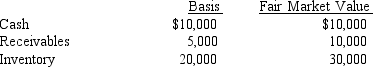

The Dominguez Partnership has the following assets on December 31:  Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

A) 0

B) $1,000

C) $2,000

D) $3,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Sabrina is single and has taxable income

Q10: What tax year end must a partnership

Q12: What is the difference between a limited

Q14: How does a shareholder's basis in his

Q24: A general partner in a limited partnership

Q27: Ray, Ronnie and Joe are partners in

Q32: Recourse debts can only be satisfied with

Q34: Carol owns 40 percent of CJ Partnership.The

Q68: Limited liability companies are generally taxed as

Q77: Logan's basis in his partnership interest is