Multiple Choice

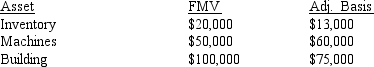

What is Alexander's net gain or loss on the liquidation of his 100 percent interest in an S corporation if the corporation distributes the following three assets to him in exchange for his stock:  Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

A) ($12,000)

B) ($22,000)

C) $10,000

D) $22,000

Correct Answer:

Verified

Correct Answer:

Verified

Q41: A loss is never recognized on a

Q51: Michael was a partner in the M&M

Q55: There are special rules for an S

Q59: Natalie, a partner in a real estate

Q60: The Clio Corporation, an S corporation, makes

Q61: The LBJ Partnership has a March 31

Q63: What is a sole proprietorship and how

Q64: Other Objective Questions<br>Indicate by a PRP if

Q68: Briefly explain the difference between the entity

Q80: The passive activity loss rules apply<br>A)before the