Essay

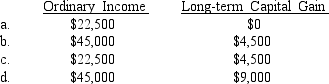

Dominguez Corporation, a calendar-year S corporation, has book income of $54,000 ($45,000 from operations and a $9,000 net long-term capital gain). During the year, Dominquez distributes $22,500 to its three equal shareholders, all of whom are calendar year taxpayers. What is the total amount of Dominguez's ordinary income and capital gains passed through to its shareholders at the end of the year?

Correct Answer:

Verified

d; all ordinary inco...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: A sole proprietor:<br>A)deducts his or her retirement

Q36: A person satisfies material participation requirements only

Q74: A sole proprietorship:<br>A)must be owned by an

Q76: The limited liability partnership form of business

Q124: How is an S election terminated?

Q126: Clarence receives a liquidating distribution of receivables

Q127: Lopez Corporation, an existing C corporation, wants

Q130: Simpco Partnership has gross operating revenue of

Q132: Quincy received a liquidating distribution of $5,000

Q133: ABC Partnership has two assets: inventory (fair