Multiple Choice

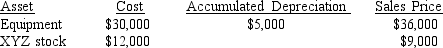

Ethan, a sole proprietor, sold the following assets in 2018:  The equipment was purchased several years ago but the XYZ stock was purchased as an investment on 3/9/18 and was sold on 11/15/18. Ethan is in the 32% marginal tax bracket for 2018. At the beginning of 2018, he had $2,000 of unrecaptured Section 1231 losses from 2 years ago. How much additional tax will Ethan pay as a result of these transactions?

The equipment was purchased several years ago but the XYZ stock was purchased as an investment on 3/9/18 and was sold on 11/15/18. Ethan is in the 32% marginal tax bracket for 2018. At the beginning of 2018, he had $2,000 of unrecaptured Section 1231 losses from 2 years ago. How much additional tax will Ethan pay as a result of these transactions?

A) $1,200

B) $1,650

C) $2,390

D) $2,640

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Sheldon had salary income of $40,000.In addition,

Q2: The holding period for an asset acquired

Q8: A corporation sells a machine used in

Q9: Edna had $20,000 of ordinary income.In addition,

Q45: Determine the amount of the capital gain

Q49: Mason received $20,000 cash and equipment worth

Q65: What are the carryover provisions for unused

Q69: What is depreciation recapture?

Q70: Identify the type(s) of gain or loss

Q75: Identify the type(s) of gain or loss