Multiple Choice

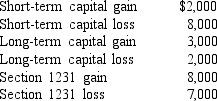

During the current year, Zach had taxable income of $100,000 before considering the following property transactions:  Two years ago Zach had a $4,000 gain from the sale of a Section 1231 asset but last year Zach had no capital or Section 1231 gains or losses. What effect will the above property transactions have on Zach current taxable income and will there be any carryforward or carryback of gains or losses?

Two years ago Zach had a $4,000 gain from the sale of a Section 1231 asset but last year Zach had no capital or Section 1231 gains or losses. What effect will the above property transactions have on Zach current taxable income and will there be any carryforward or carryback of gains or losses?

A) Reduces Zach's current taxable income by $4,000

B) Reduces Zach's current taxable income by $3,000 and he will carry $1,000 loss forward

C) Zach has $1,000 additional ordinary income this year due to recapture and he can carry the remaining losses forward

D) Zach has $1,000 additional ordinary income this year due to recapture, he can deduct $3,000 loss this year, and can carry any remaining losses forward

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In what order are capital gains subject

Q4: Taxpayer B has the following gains and

Q5: Identify the type(s) of gain or loss

Q8: George and Sally sold their primary residence

Q10: Identify the type(s) of gain or loss

Q33: Shawn, a single taxpayer, sold the house

Q52: Carol used her auto 60 percent for

Q53: A gain must be recognized unless some

Q58: Gain representing depreciation recapture on equipment is

Q71: On March 17, a calendar-year taxpayer sells