Multiple Choice

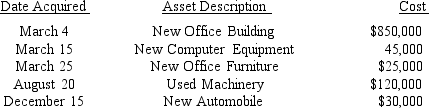

YumYum Corporation (a calendar-year corporation) moved into a new office building adjacent to its manufacturing plant in 2018. It purchased and placed in service the following assets during 2018:  All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. What is the maximum Section 179 deduction YumYum can claim for 2018?

All assets are used 100% for business use. The office building does not include the cost of the land on which it is located that was an additional $300,000. The corporation had $900,000 income from operations before calculating depreciation deductions. What is the maximum Section 179 deduction YumYum can claim for 2018?

A) $500,000

B) $253,160

C) $208,000

D) $25,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: When fully depreciating 7-year property, the final

Q26: What is a mixed-use asset? What adjustment

Q28: On June, 20, 2018, Simon Corporation (a

Q29: Explain how the basis of an asset

Q32: What is the maximum amount that can

Q33: Zachary purchased a new car on August

Q34: Other Objective Questions<br>Indicated by a P for

Q35: Chipper, a calendar-year corporation, purchased new machinery

Q36: The alternative depreciation system uses a straight-line

Q59: MACRS depreciation for 5-year assets is based