Multiple Choice

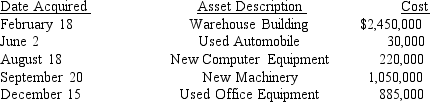

Sanjuro Corporation (a calendar-year corporation) purchased and placed in service the following assets during 2018:  All assets are used 100% for business use. The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000. The corporation has $3,000,000 income from operations before calculating depreciation deductions. Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2018.

All assets are used 100% for business use. The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000. The corporation has $3,000,000 income from operations before calculating depreciation deductions. Sanjuro Corporation made whatever elections were necessary to maximize its overall depreciation deduction for 2018.

What was Sanjuro Corporation's maximum total cost recovery deduction for 2018?

A) $512,550

B) $1,731,707

C) $2,175,000

D) $2,228,052

Correct Answer:

Verified

Correct Answer:

Verified

Q60: YumYum Corporation (a calendar-year corporation) moved into

Q62: What is the difference between depreciation, depletion,

Q63: On June, 20, 2018, Simon Corporation (a

Q65: What limitations apply to the use of

Q66: In a basket purchase of a group

Q66: Josephine Company, a sole proprietorship whose owner

Q67: Rodriguez Corporation acquired 7-year property costing $450,000

Q69: Other Objective Questions<br>Indicated by a P for

Q73: Research expenditures must be capitalized and amortized

Q79: All of the following are characteristics of