Multiple Choice

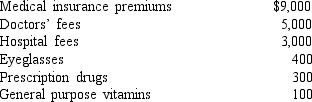

Camila, age 60, is single and has adjusted gross income of $100,000. She paid (with after-tax dollars) the following medical expenses in 2018:  She received only $2,000 in reimbursements from her insurance company for her medical expenses. How much can Camila deduct for medical expenses in 2018 if she has $30,000 of other itemized deductions?

She received only $2,000 in reimbursements from her insurance company for her medical expenses. How much can Camila deduct for medical expenses in 2018 if she has $30,000 of other itemized deductions?

A) $8,200

B) $8,300

C) $5,800

D) $5,700

Correct Answer:

Verified

Correct Answer:

Verified

Q15: All of the following are qualifying relatives

Q26: A legally married couple can elect to

Q48: A homeowner who itemizes his or her

Q61: A married person filing a separate return

Q62: Contributions to health savings accounts are made

Q77: Sebastian (age 46) and Kaitlin (age 45)

Q79: What is the standard deduction for a

Q84: Susan (age 29) is single but has

Q85: Toni is 61 and blind; her husband,

Q87: Ikito's AGI was $68,000 in 2017 and